The USD6bn E-Grocery Market in Indonesia

Fierce competition and much-needed collaboration.

This is originally posted separately between Aug 30 and Sep 27 before this blog rebranded (fka Bisa Berkarir) and revamped its format. Compiling and re-posting them here in an easy-to-read format.

001 Partners is your gateway to Indonesia's startup and VC ecosystem via its weekly stories, in-depth ideas, and founders’ playbook (shortly!) 🤙🏻

Join hundreds of founders, global & regional VCs, and talents by subscribing here:

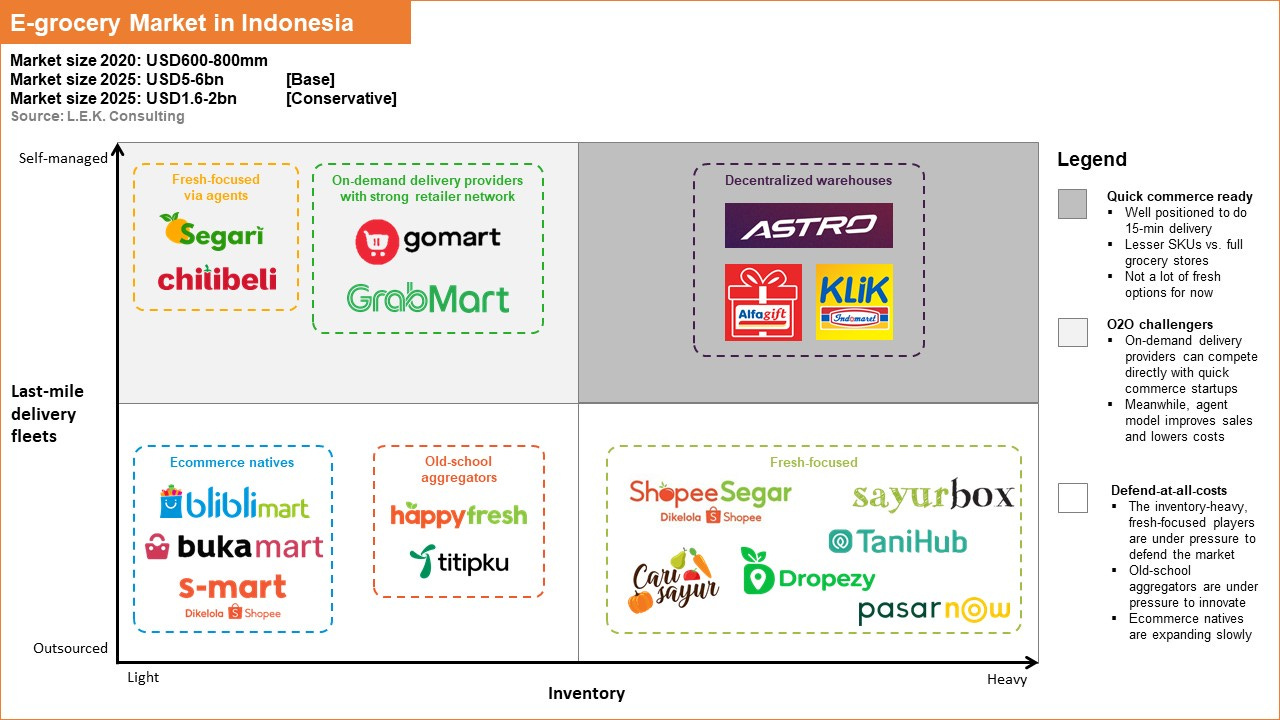

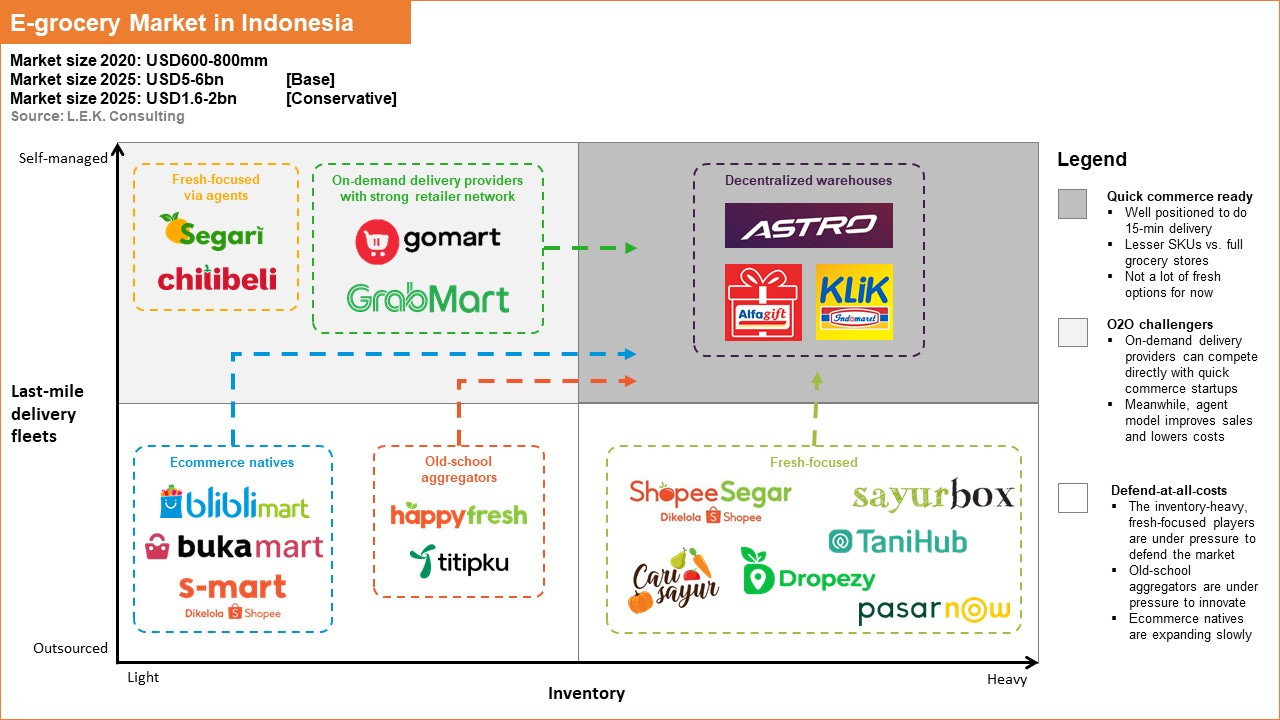

Previously, Indonesia only had 4 types of players in the e-grocery space:

Fresh produce ecommerce (e.g., Sayurbox, Tanihub)

Aggregator model that partners with modern retailers (e.g., HappyFresh)

Ecommerce selling groceries (e.g. Tokopedia, Shopee, Blibli)

Convenience stores with online deliveries (e.g., Klik Indomaret, Alfa Gift).

As the e-grocery space is heating up, new players emerge with unique business models and old players raise more capital to defend their turfs.

The chart below presents some of the key players in the space across different business models.

Despite the crowded market, the e-grocery segment has been growing >50% compared to pre-covid levels with strong signs of user stickiness as purchasing groceries online becoming mainstream according to RedSeer.

Unit economics has always been challenging due to the low-margin nature of FMCG and costly delivery fees. Players with more fresh SKUs will naturally enjoy higher margins but ensuring consistent supply has proven to be a challenge. Other potential monetizations include adopting the inventory-heavy model, introducing white-label products, monetizing sales data, and running campaigns for FMCG principals.

That said, there is no truly dominant player now and VCs are still very bullish on the space. This allows existing players to raise funds as they are educating the market and figuring out the path to profitability. The space will only get more interesting in the years to come.

The Rise of Quick Commerce Model

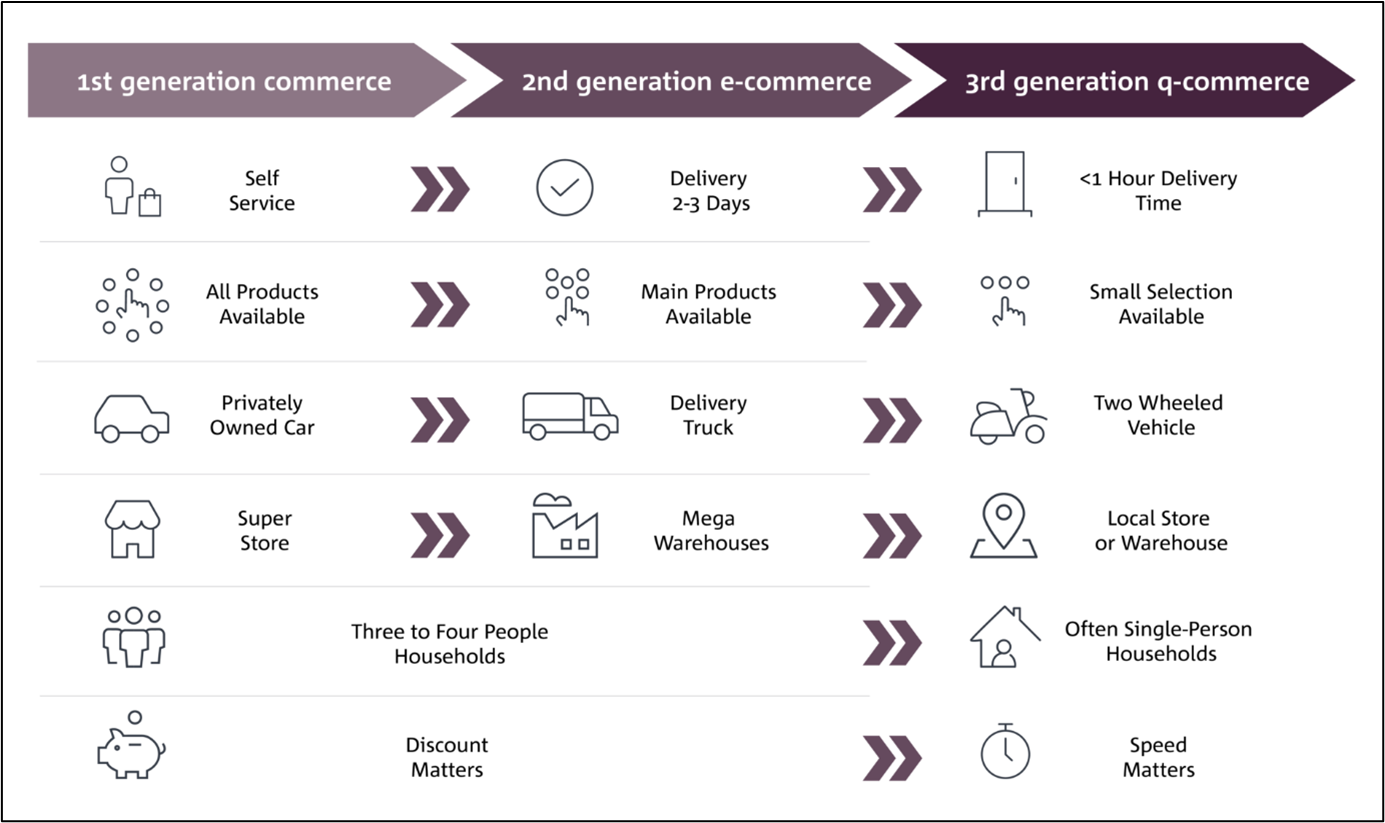

The beauty of ecommerce platform lies in its zero-inventory, asset-light business model… until it is not. The next generation of commerce is inventory-heavy, owns its fulfillment centers, and expands as quickly as possible. Introducing quick commerce.

These startups introduce ultra-fast delivery of items available in groceries and convenience stores: 10-40 minutes, available 24/7.

Is ecommerce same-day delivery not enough? In the western market, apparently, it is not. Customer behavior changes: they buy what they want and they want it now. The pandemic speeds up the need for speed (no pun intended) and convenience, more than ever before.

How are they doing this again? They disrupt the last-mile delivery by purchasing inventory, storing them in nearby micro-fulfilment centers across the city, and fulfil them when an order is received. Think of them as Indomaret/Alfamart + SiCepat/J&T on steroid!

Mind you, Gopuff, the ‘OG’ of the space, has just raised USD1bn at a USD15bn valuation, almost 2x its valuation in Mar’21. Take a deep breath and imagine double your ‘worth’ in <6 months’ time. Part of the reason for such frothy valuations is that there is so much liquidity (read: investors’ $) in the market right now.

The VCs are hugely divided on similar players: the backers think they are capturing the new customer behavior, while some believe they are just WeWork in the making.

Then comes Astro. It aims to be the 1st quick commerce startup in Indonesia knowing that the market has much lesser liquidity and less developed customer behavior compared to its western counterparts.

How Quick Commerce Model Works

Retail Brew recently went to one of the 10 hubs of quick commerce JOKR in Williamsburg to understand how the startup operates. Founded in Mar’21, it raised USD170mm in its Series A round 3 months after and currently operates in the US, Europe, and Latin America.

Retail Brew noticed that the hub was relatively small and organized with different aisles for different categories of goods just like a typical supermarket. It has >1.8k SKUs that are mostly FMCG goods from cheese, frozen pizzas, eggs, cleaning supplies, spices, to diapers. This is to be compared to a typical grocery store with >15k SKUs.

How it works:

A big screen in the hub shows the latest orders

Pickers pick up the goods and pack the goods in a cooler bagh

Goods are handed over to the courier to deliver in under 20 mins.

Interestingly, there is no delivery fee nor a minimum order amount imposed on the buyers. Hence, it bets (big) on the many hubs across the city to increase inventory turnover and reduce wastage.

The hub locations were chosen in areas with a high population density that could purchase the highest basket size. Then, the startup will hyperlocalize the inventory in each hub according to the consumption trends and patterns. Additionally, it aims to deliver to customers within a 1.6 km radius.

The level of optimization is granular: more app sessions in the morning were translated to adding fresh bagels to the assortment leading to an increase in total sales. The same went to users looking for certain types of bread on the weekend just to see the bread was readily available every day after JOKR signed a local partnership with a local bakery.

The team also claimed that albeit the inventory model and no delivery fee were inherently risky, JOKR had been comfortable in terms of the average basket size and delivery frequency. Indeed, it is essentially a tech-enabled e-grocery startup competing with existing e-grocery giants with a centralized warehouse and one-day delivery service.

What’s Ahead for Indonesia

Given the many new lifestyles we start to develop in the past year, e-grocery seems to have a bright future in the consolidation of retailers and platforms. People are now starting to demand quick delivery of grocery items without stepping out of the house.

As food delivery still accounts for the largest market for ‘instant delivery’, existing players with available infrastructure and a fleet of riders seems to be well-positioned to provide the 15-min e-grocery delivery. Just like how US-based DoorDash launched DashMart and EU-based Delivery Hero launched Dmarts, Grab has started to roll out GrabSupermarket in the region.

Existing e-grocery players are also under pressure to provide a similar delivery time to customers. HappyFresh, which recently broke up with Grab as Grab launched its own GrabMart, is trying to boost its operations capabilities by increasing its own fleet of riders.

Sources familiar with the matter said that ShopeeSegar is launching its instant delivery soon, while HappyFresh’s and Dropezy’s latest funding round aims to pivot to the quick commerce model by building dark stores and providing 20-min delivery.

Earlier the year, sources familiar with the matter said that GoTo acquired >11% stake in Lippo’s Matahari Putra Prima (IDX: MPPA), the operator of 222 stores of Hypermart, Foodmart, Hyfresh, Primo, Boston HBC, FMX, and SmartClub in 72 cities in Indonesia, serving as potential warehouses for GoMart and Tokopedia. Subsequently, Blibli acquired 51% stake in Supra Boga Lestari (IDX: RANC), the operator of 48 stores of 99 Ranch Market and Farmers Market in 9 cities, to strengthen its Bliblimart as it sees immense growth during this e-grocery boom.

However, if the market could learn from the pioneers of 15-min grocery delivery ranging from Kozmo.com during the heyday of the dot-com bubble (raised >USD250mm back in the late 90s, which went out of business just after 3 years of operations) to current Chinese players (Dingdong Maicai, Miss Fresh, and Meituan Maicai), it is that instant delivery model is not nearly enough to bring customers away from existing ecommerce platforms (in China’s case: Pinduoduo, JD’s Super, and Alibaba’s Taoxianda).

The already low-profit margin of the FMCG distribution model gets narrower due to the instant delivery model. The potentially aggressive sales and marketing spending due to the challenging competitive landscape is not helping either.

Understanding this, the immediate ‘homework’ of all existing and aspiring quick commerce players include:

Raising funds from both major investors and local value-add investors

Building hyperlocal capabilities from go-to-market strategy to tactical execution

Reducing the cost of delivery per order (e.g., increasing the number of orders fulfilled per trip)

Increasing use cases of instant delivery to boost additional revenues

As the environment is pretty much set, the many players are well-advised to work hand in hand to increase the penetration rate of online groceries in Indonesia.

Only once the market is sizeable enough, the battle between David (cash-strapped but laser-focused e.g., Astro, Dropezy) and Goliath (strong capital base, but just one of the many operating units within a more-bureaucratic organization e.g., Grab, GoTo) should start.